Solved in 3 steps with 2 images SEE SOLUTION Check out a sample Q&A here Knowledge Booster Learn more about Determination of Tax Liability Need a deep-dive on the concept behind this application?

Your work survival kit: 12 must-haves | Young Living Blog – US EN

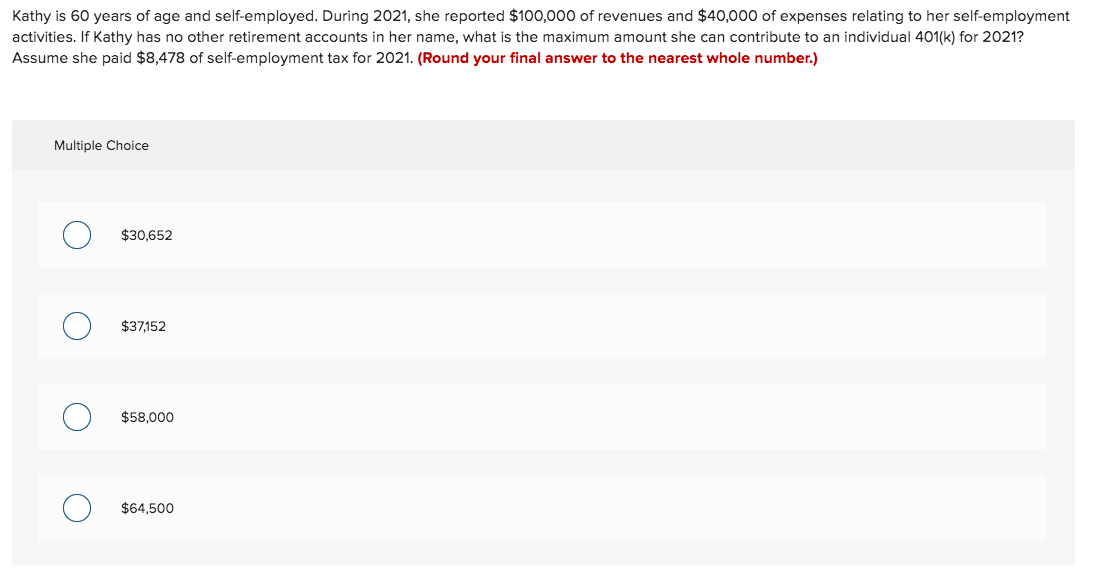

Section: Chapter Questions format_list_bulleted Problem 38P Concept explainers Question questio 17 Transcribed Image Text: Kathy is 60 years of age and self-employed. During 2023, she reported $504,000 of revenues and $100,800 of expenses relating to her self– employment activities.

Source Image: homework.study.com

Download Image

Section: Chapter Questions Problem 22CE See similar textbooks Related questions Question 100% Transcribed Image Text: Kathy is 60 years of age and self-employed. During 2023, she reported $522,000 of revenues and $104, 400 of expenses relating to her self-employment activities.

1200x348.jpg)

Source Image: rezolve.ai

Download Image

Blog – Beau Photo Supplies Inc. A. $381,867. B. $80,000. C. $61,000. D. $55,000. 2. Kathy is 60 years of age and self-employed. During 2018, she reported $516,000 of revenues and $103,200 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to an individual 401 (k) for 2018

Source Image: bu.edu

Download Image

Kathy Is 60 Years Of Age And Self Employed

A. $381,867. B. $80,000. C. $61,000. D. $55,000. 2. Kathy is 60 years of age and self-employed. During 2018, she reported $516,000 of revenues and $103,200 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to an individual 401 (k) for 2018 May 23, 2022Kathy is 60 years of age and self-employed. During 2018, she reported $112,000 of revenues and $42,400 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to a simplified employee pension (SEP) IRA for 2018?

Are You a Novid—Someone Who’s Never Had COVID? Science Has Some Clues Why | BU Today | Boston University

Kathy is 60 years of age and self-employed. During 2018, she reported $532,000 of revenues and $106,400 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to an individual 401(k) for 2018? (Round your final answer to the nearest whole number) Gen Z – Key Characteristics no.5 – Apprehensive

Source Image: linkedin.com

Download Image

What Would I Tell My Sixty-Year-Old Self? Kathy is 60 years of age and self-employed. During 2018, she reported $532,000 of revenues and $106,400 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to an individual 401(k) for 2018? (Round your final answer to the nearest whole number)

Source Image: linkedin.com

Download Image

Your work survival kit: 12 must-haves | Young Living Blog – US EN Solved in 3 steps with 2 images SEE SOLUTION Check out a sample Q&A here Knowledge Booster Learn more about Determination of Tax Liability Need a deep-dive on the concept behind this application?

Source Image: youngliving.com

Download Image

Blog – Beau Photo Supplies Inc. Section: Chapter Questions Problem 22CE See similar textbooks Related questions Question 100% Transcribed Image Text: Kathy is 60 years of age and self-employed. During 2023, she reported $522,000 of revenues and $104, 400 of expenses relating to her self-employment activities.

Source Image: beauphoto.com

Download Image

My Book Boyfriend (New York Spark #1) by Kathy Strobos | Goodreads Kathy is 60 years of age and self-employed. During 2020 she reported $109,000 of revenues and $41,800 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to a SEP IRA for 2020?

Source Image: goodreads.com

Download Image

Celebrity Chef Kathy Fang On What It Takes to Create a Highly Successful Career as a Restaurateur | by Maria Angelova, CEO of Rebellious Intl. | Authority Magazine | Medium A. $381,867. B. $80,000. C. $61,000. D. $55,000. 2. Kathy is 60 years of age and self-employed. During 2018, she reported $516,000 of revenues and $103,200 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to an individual 401 (k) for 2018

Source Image: medium.com

Download Image

Solved Kathy is 60 years of age and self-employed. During | Chegg.com May 23, 2022Kathy is 60 years of age and self-employed. During 2018, she reported $112,000 of revenues and $42,400 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to a simplified employee pension (SEP) IRA for 2018?

Source Image: chegg.com

Download Image

What Would I Tell My Sixty-Year-Old Self?

Solved Kathy is 60 years of age and self-employed. During | Chegg.com Section: Chapter Questions format_list_bulleted Problem 38P Concept explainers Question questio 17 Transcribed Image Text: Kathy is 60 years of age and self-employed. During 2023, she reported $504,000 of revenues and $100,800 of expenses relating to her self– employment activities.

Blog – Beau Photo Supplies Inc. Celebrity Chef Kathy Fang On What It Takes to Create a Highly Successful Career as a Restaurateur | by Maria Angelova, CEO of Rebellious Intl. | Authority Magazine | Medium Kathy is 60 years of age and self-employed. During 2020 she reported $109,000 of revenues and $41,800 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to a SEP IRA for 2020?